Why Some Homes Sell Quickly – and Others Don’t Sell at All

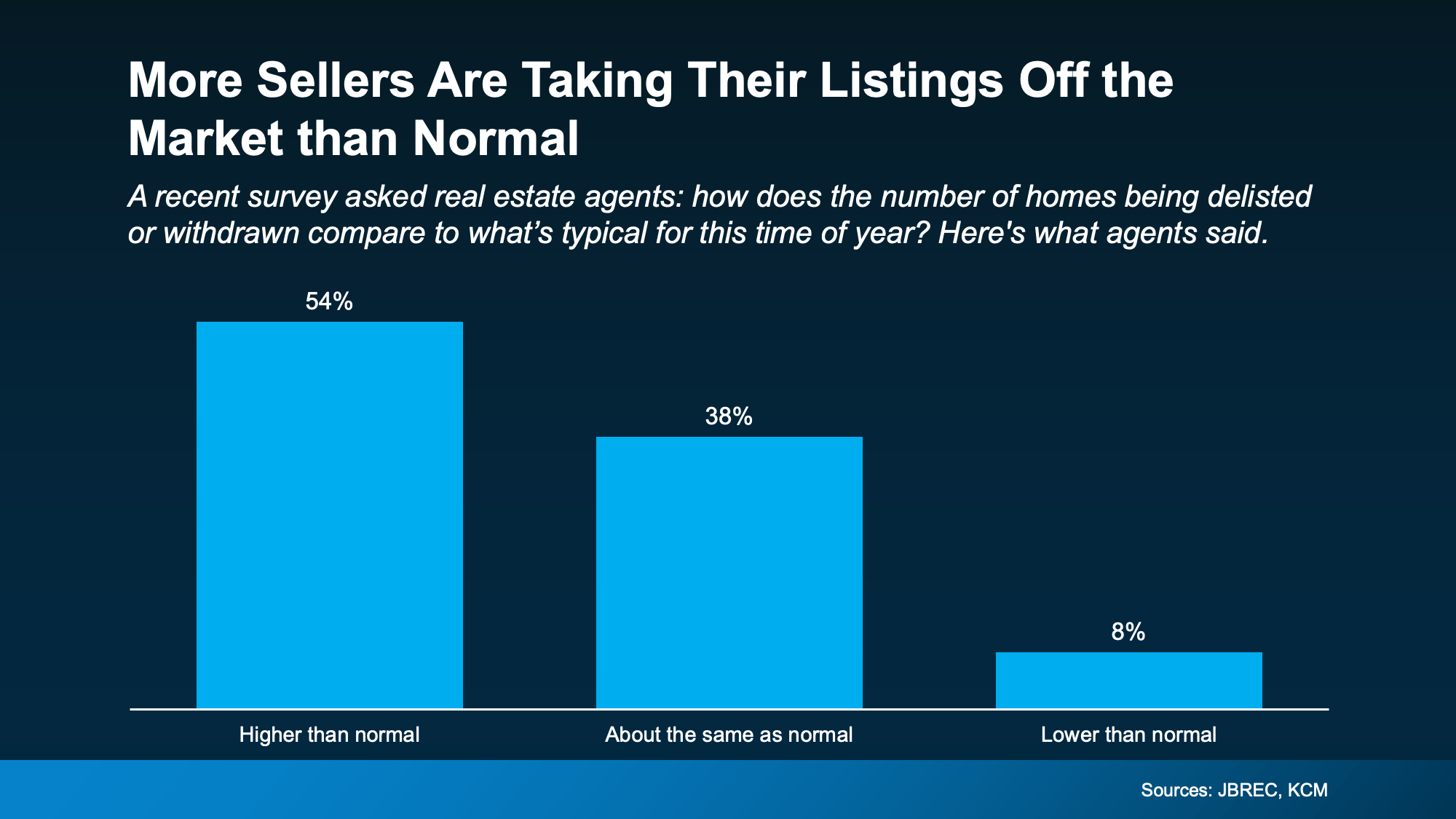

A few years ago, inventory hit a record low. Just about anything sold – and fast. But now, there are far more homes on the market. Listings are up almost 20% from this time last year. And in some areas, supply is even back to levels we last saw in 2017–2019. For sellers, that means one thing:

Your house needs to stand out and grab attention from day one.

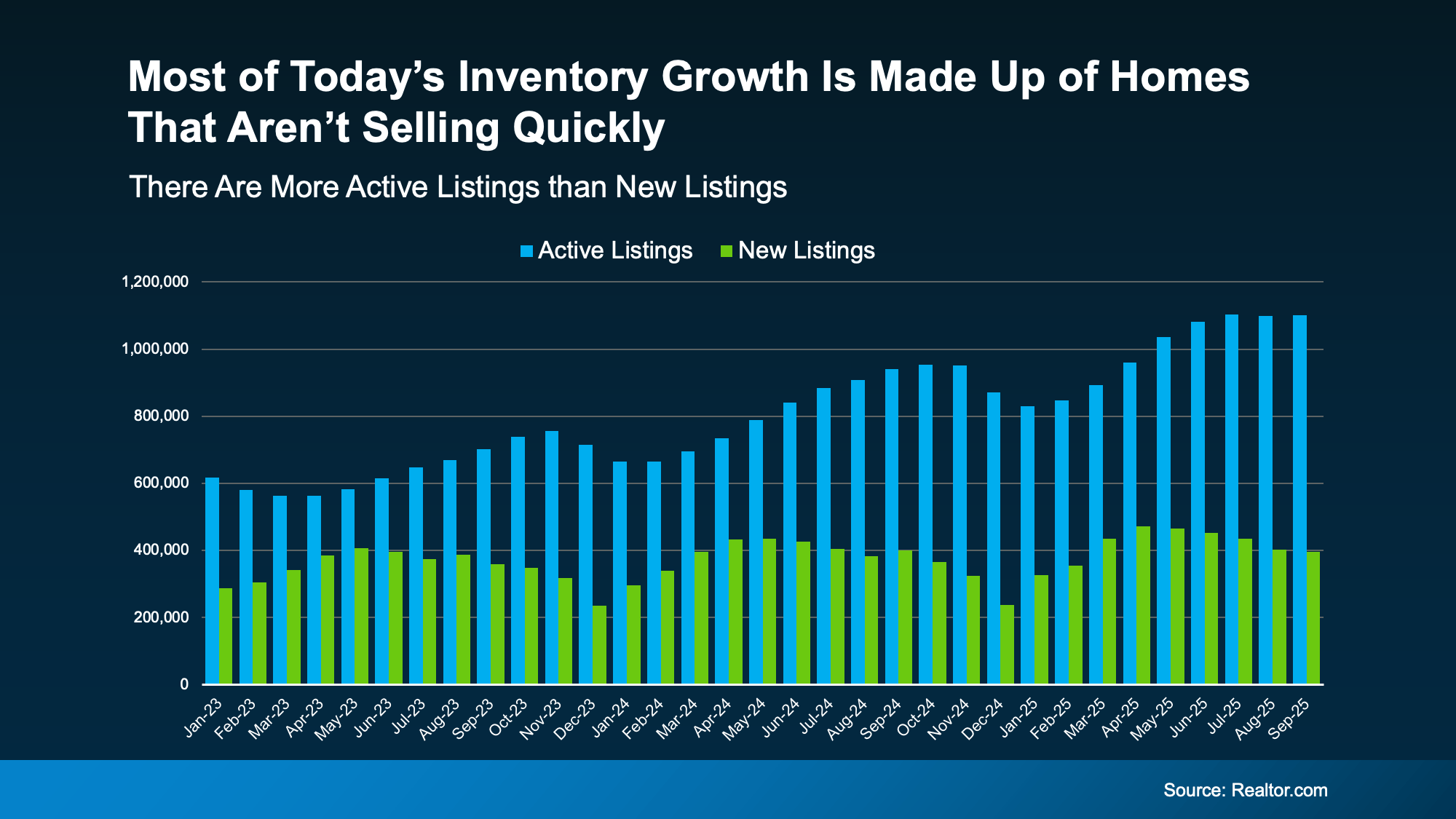

That’s especially true when you consider why the number of homes for sale is up. Here’s how it works. Available inventory is a mix of:

- Active Listings: homes that have been sitting on the market, but haven’t sold yet

- New Listings: homes that were just put on the market

Data from Realtor.com shows most of the inventory growth lately is actually from active listings that are staying on the market and taking longer to sell (see the graph below).

The blue bars show active listings. These are the homes that are sitting month to month and not selling. The green bars are new listings, the homes that were just put on the market. And it’s clear there are fewer new listings compared to how many are staying on the market unsold.

Since you don’t want your house to be one of the ones that take a long time to sell, let’s break down where things can go sideways and how to set yourself up to sell quickly.

Since you don’t want your house to be one of the ones that take a long time to sell, let’s break down where things can go sideways and how to set yourself up to sell quickly.

Why Some Homes Sell and Others Sit

The secret to selling in today’s market is simple. Make sure your house is easy for buyers to say yes to as soon as it is listed.

Price it based on current conditions (not what your neighbor sold for 3 years ago). Make important repairs. And highlight the best things about your house. If you do that, it will sell in any market – sometimes even faster than you’d think. Because the truth is, homes that are priced right today are still selling.

It’s the homeowners who are clinging to outdated expectations that are seeing their house sit and their listing go stale. According to Redfin and HousingWire, here are some of the most common reasons sales stall out:

- Priced it too high from the start

- Skipped necessary repairs before listing

- Didn’t stage the house well

- Sellers won’t negotiate with buyers

- Limited availability for showings

- Ineffective marketing or listing pictures

Most of those things didn’t matter as much just a few years ago. When inventory was at a record low, sellers could skip the prep, name their price, and still walk away with multiple offers over their asking price.

But today’s market is different now that inventory has grown. And that means your approach needs to be different too.

You don’t want to try out old strategies and aim too high just to see what sticks. Your first few weeks on the market are everything. That’s when your listing gets the most attention – and when pricing or presentation mistakes hurt the most. Get it wrong up front and your house will sit…and sit. Get it right, and it’ll be snatched up before you know it.

The Right Agent Helps Your House Stand Out

Selling quickly isn’t about luck. It’s about knowing how to play to the market you’re in. And that’s where your agent comes in.

A great agent will analyze your local market, suggest a price based on the latest comparables sold in your neighborhood, and create a marketing plan that makes buyers pay attention from day one. They’ll also walk you through any repairs you need to make or whether you need to bring in a staging company. As the National Association of Realtors (NAR) explains:

“Home sellers without an agent are nearly twice as likely to say they didn’t accept an offer for at least three months; 53% of sellers who used an agent say they accepted an offer within a month of listing their home.”

That’s the power of getting it right (and getting expert help) from the start.

Bottom Line

There are more homes for sale today than there were even just a year ago, but that doesn’t have to work against you.

When your house is priced right, shows well, and is marketed effectively, it will sell. Let’s connect if you want to know how to make that happen in our market this fall.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

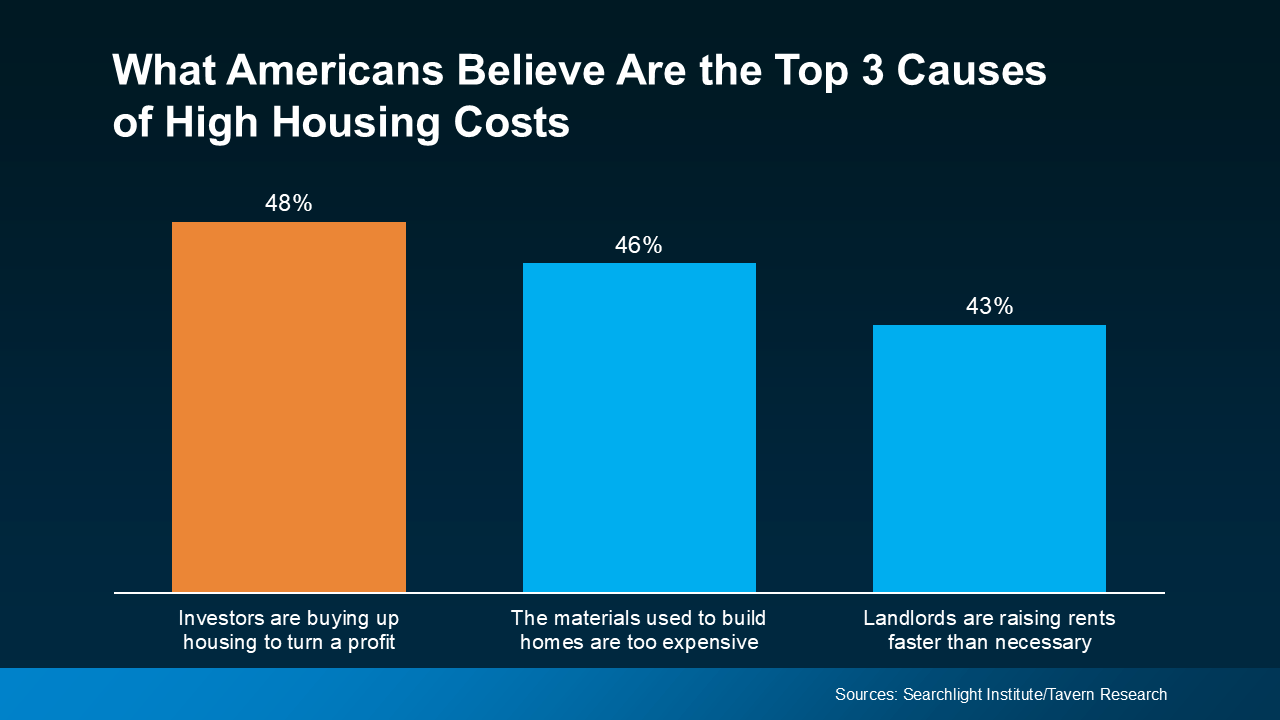

But that theory doesn’t actually hold up once you look at the data.

But that theory doesn’t actually hold up once you look at the data.

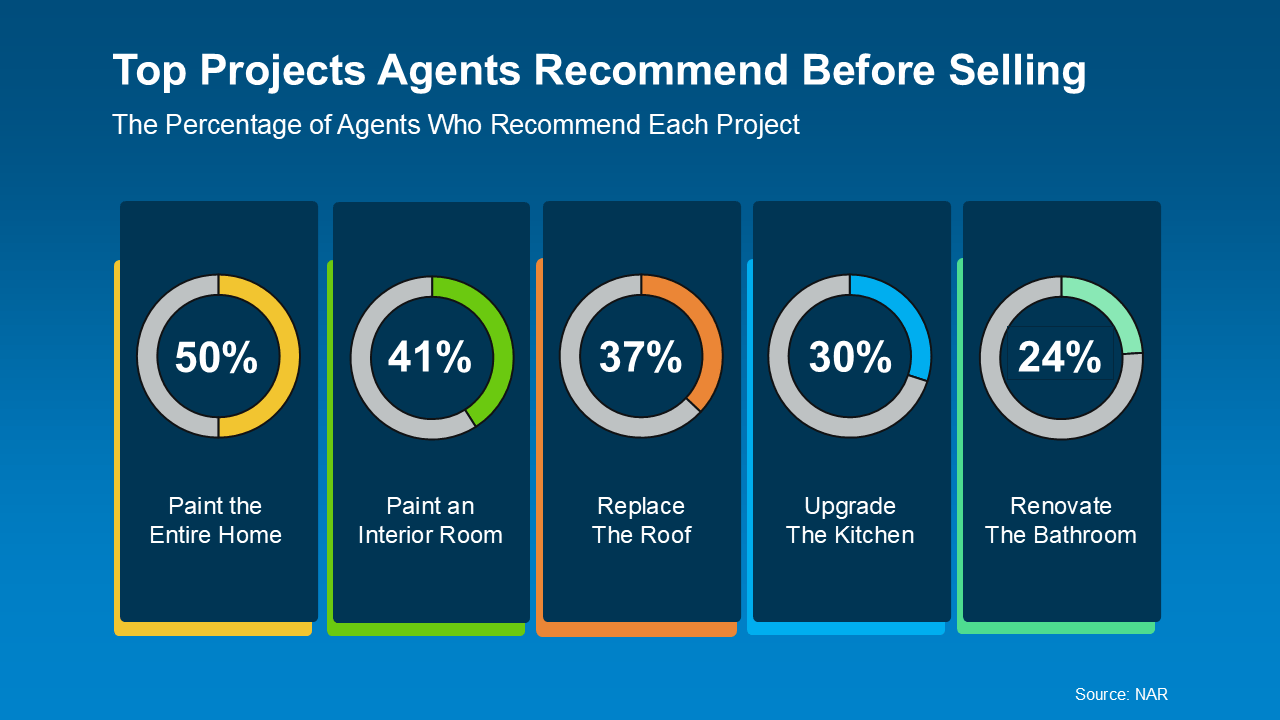

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.

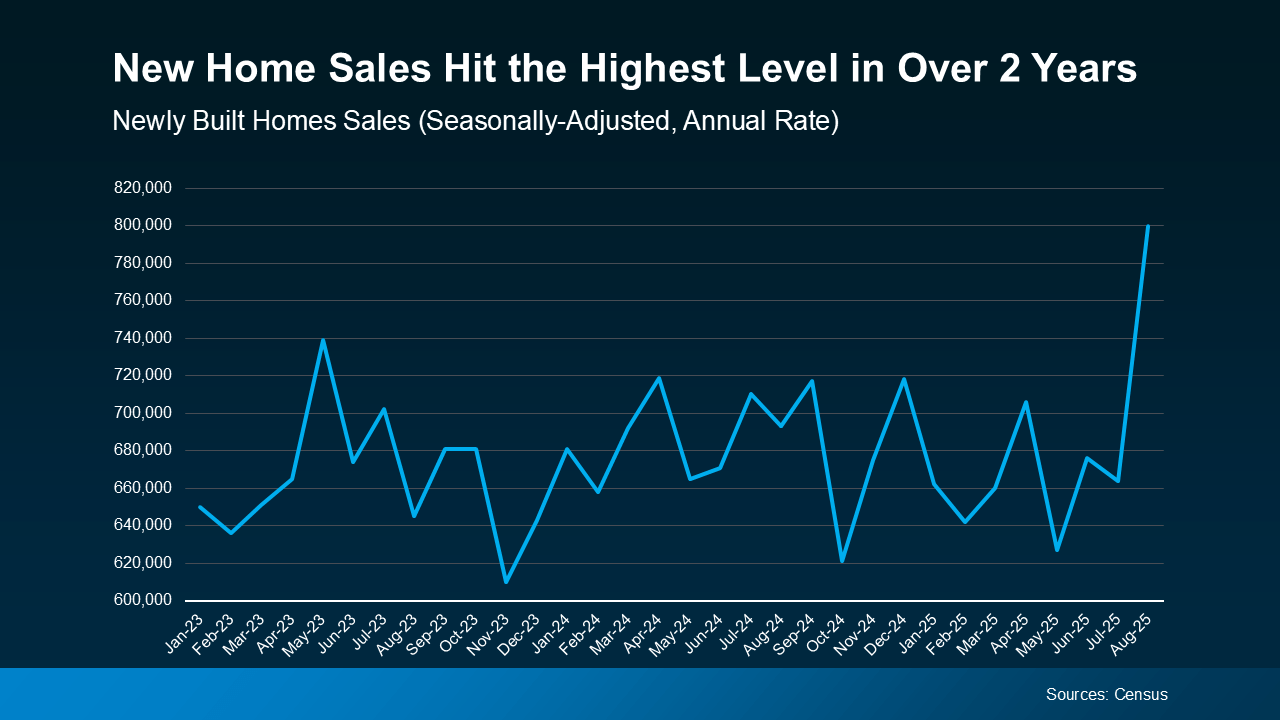

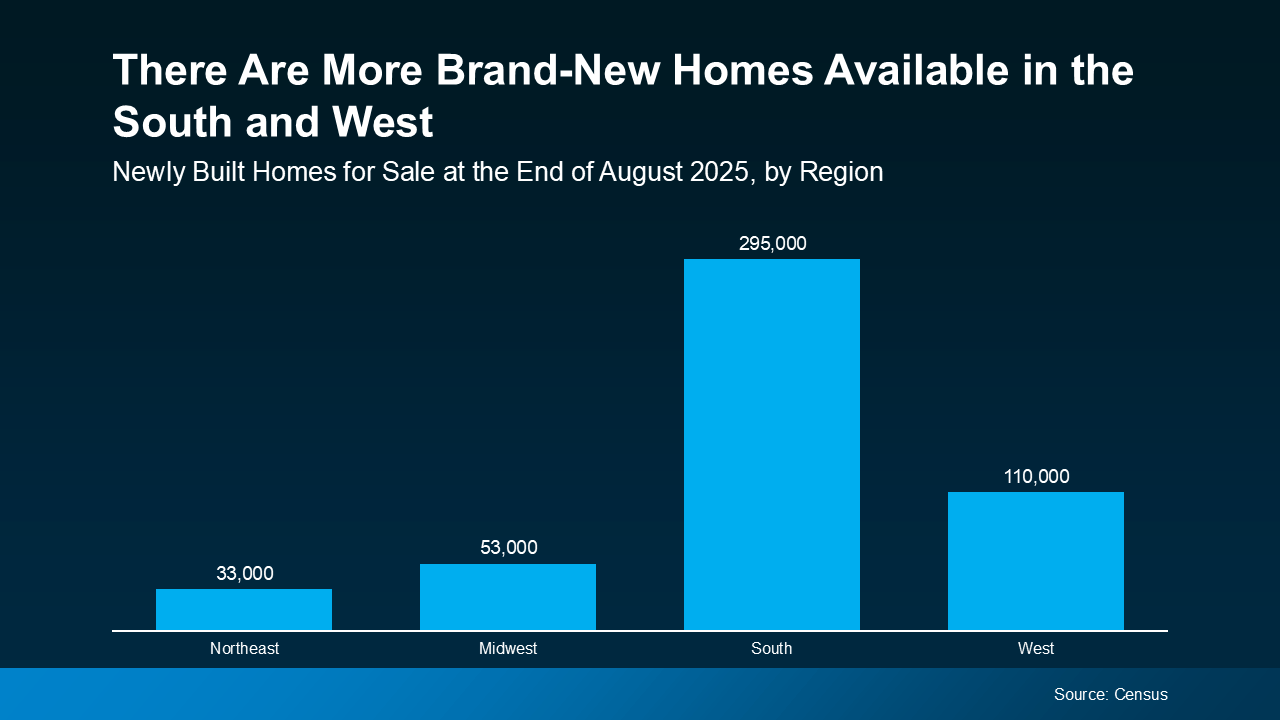

Why Builders Are Throwing in Perks

Why Builders Are Throwing in Perks

BrightMLS

BrightMLS